how to calculate nj taxable wages

This marginal tax rate means that. You must report all payments whether in cash benefits or property.

Aatrix Nj Wage And Tax Formats

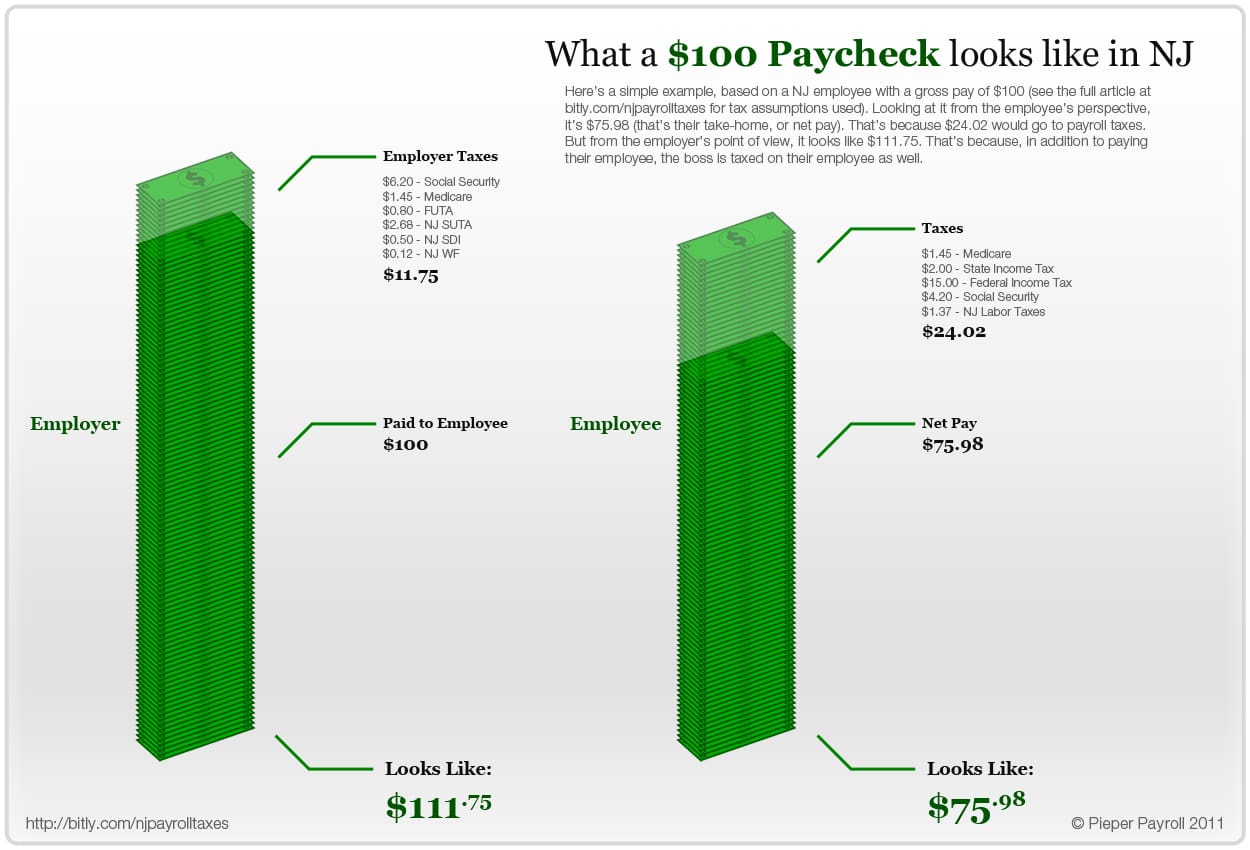

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Words Templates 2020 New Jersey Payroll Tax Rates Abacus Payroll.

. - FICA Social Security and Medicare. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Using our New Jersey Salary Tax Calculator.

The total amount of money paid to an. Incredibly a lot of people fail to allow for the income tax deductions when completing their annual tax return inNew Jersey the net effect for those individuals is a higher state income tax bill in New Jersey and a higher Federal tax bill. 175 on taxable income between 20001 and 35000.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with a full breakdown of the tax you are paying. The wages you report for federal tax purposes may be different than the wages you report for New Jersey purposes.

How to calculate nj taxable wages Friday June 10 2022 Edit. Like most US States both New York and New Jersey require that you pay State income taxes. The most they can contribute for 2020 is 35074.

Census Bureau Number of cities with local income taxes. The state income tax system in New Jersey has. This results in roughly of your earnings being taxed in total although depending on your situation there may be some other.

Of that amount being taxed as federal tax. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all.

Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. Line balance must be paid down to zero by February 15 each year. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. New Jersey does include a few additional items in taxable income that are not included on either your New York or your Federal return. That means that workers who do not earn 134900 in a year will continue to have deductions taken out year round.

In short youll have to file your taxes in both states if you live in NJ and work in NY. Your average tax rate is 1198 and your marginal tax rate is 22. Press Calculate to see your New Jersey tax and take home breakdown including Federal Tax deductions.

How to calculate taxable wages. Calculate salaried employees paychecks by dividing their salary by the number of pay periods per year. The Unemployment Trust Fund reserve ratio is calculated as follows.

The states SUTA wage base is 7000 per employee. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator.

How many income tax brackets are there in New Jersey. - New Jersey State Tax. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. New Jersey has a reciprocal tax agreement with Pennsylvania but. Since your business has.

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. You shouldnt need to have to do anything more. Some states have reciprocal tax agreements allowing you only to pay taxes in your home state.

New Jersey Paycheck Quick Facts. Taxable Income in New Jersey is calculated by subtracting your tax deductions from your gross income. Being taxed for FICA purposes.

Calculate hourly employees wages by multiplying the number of hours worked by their pay rate including a higher rate for any overtime hours worked. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. Taxable Retirement Income. As of January 1 2020 workers contribute 026 of the first 134900 earned during the calendar year.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans. Switch to New Jersey hourly calculator.

Figure out your filing status. The most they can contribute for 2019 is 5848. How to Calculate Withhold and Pay New Jersey Income Tax Withholding Rate Tables Instructions for the Employers Reports Forms NJ-927 and.

Gross wages are the starting point from which the IRS calculates an individuals tax liability. There are two main types of wages. The fact that your W-2 already reflects the variance is a strong indicator that your company has already reported these amounts to NJ for tax considerations.

New Jersey income tax rate. Of your earnings being taxed as state tax calculation based on 2022 New Jersey State Tax Tables. O You can exclude from New Jersey Gross Income Tax the same pay that is excluded for federal income tax purposes using the federal definitions of combat zone pay.

How Do State And Local Individual Income Taxes Work Tax Policy Center

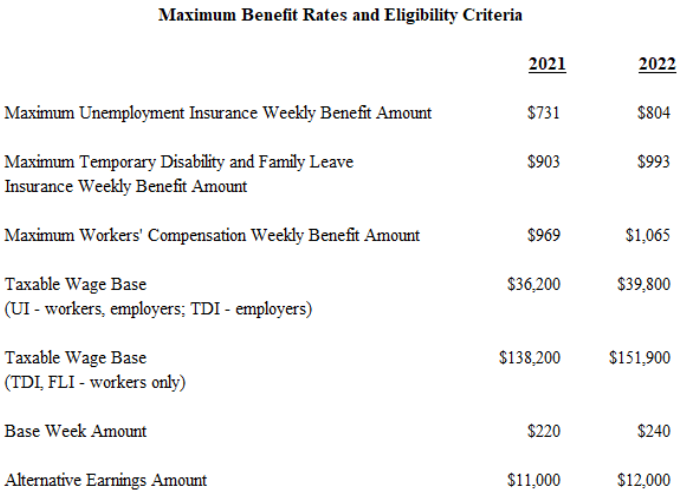

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

2022 Federal Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

Five States Ca Nj Ri Ny Hi Offer Paidleave For Temporary Disability Learn More In A New Report Family Medical Medical Leave Medical

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

2020 New Jersey Payroll Tax Rates Abacus Payroll

2019 New Jersey Payroll Tax Rates Abacus Payroll

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Aatrix Nj Wage And Tax Formats

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Words Templates